The restaurant business is cutthroat even during the best of times.

Margins are small. Competition is fierce. And good restaurant owners work very hard — often seven days a week — to maintain profitability and pay their employees.

Then COVID-19 hit Florida and its cities issued orders effectively shutting down the majority of a restaurant’s business. Restaurant owners resorted to curbside pick up and Uber Eats delivery to keep some revenue coming in. But it’s not enough.

Hotels may have it even worse. Hoteliers are already projecting revenue losses of greater than 50% for the first half of the year. Nearly 8 out of 10 hotel rooms are currently empty across the country. The impact is especially crushing for Tampa Bay area hotels, as this is peak tourist season.

Many hotels and restaurants are concerned that they simply will not be able to survive this crisis. And while the federal government has stepped up offering Small Business Administration bridge loans for businesses affected by the coronavirus, these loans are simply not enough to help businesses survive.

By now, most restaurants and hotels have called their insurance brokers to see what coverage is available to help. After all, these businesses have paid sometimes gigantic premiums to their insurance companies month after month, year after year in hopes that there will be coverage available in times of crisis like these.

Many businesses have purchased business income loss insurance or business interruption insurance. These owners assume that surely these types of insurance will apply in times like these.

But these businesses have called their insurance brokers and have been told they do not have coverage. That these policies only apply when there is physical damage to the premises. Or that these policies have exclusions for things like viruses.

At a time when businesses need it the most, insurance companies are denying claims.

Does that mean businesses out of luck?

Absolutely not.

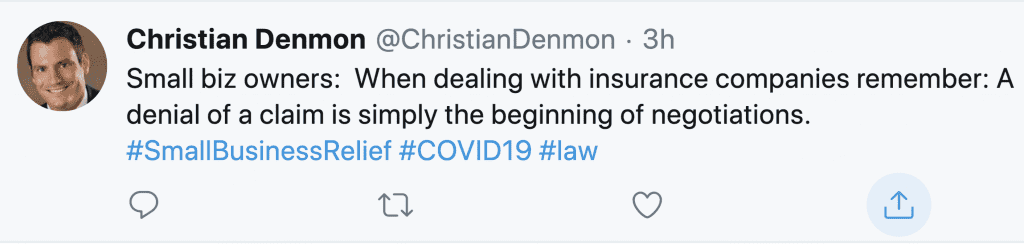

Look: Insurance companies are all about boosting their bottom line. Denying valid claims is a tried and true insurance company method to make more money.

So, of course, they are going to deny claims. COVID-19 claims will cost them greatly if they have to pay!

But that’s ok! There are attorneys who make their living fighting insurance companies who deny claims and ultimately make them pay fair value.

(Author’s Note: I can tell you that we have settled dozens of cases for a fair value in the last six months where the insurance company either denied the claim at the onset or greatly discounted the value of the claimant and offered only peanuts. A denial of a claim is just the start of negotiations.)

So, without further ado, let’s go through what you need to know about how these claims are going to be made.

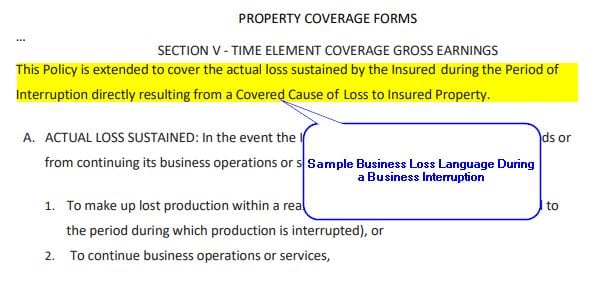

As A Preliminary Matter, You Are Looking For Business Loss Insurance AKA Business Interruption Insurance

Once You Have Determined You Have Coverage, You Need To Make A Claim

These claims are going to fall into two categories:

- Your Business Lost Income Due To COVID-19 or

- Your Business Lost Income Due To The Civil Mandate To Shut Down (Due To COVID-19).

When possible, you want to make both claims. It’s easy to know the limits of your insurance policy. That’s the max amount of money that is available on your policy. But you have to look into your policy to learn what the sub-limits are. The sub-limits may break up the amount of money that’s available in two different types of claims.

For example, you might have an insurance policy with a $5 million limit. But when you look at the business interruption insurance, it might have a $1 million limit. Looking further into the business interruption insurance, you might find that damages due to civil or military authority have a $300,000 limit.

Your claim for civil or military authority may also have certain time limits that don’t apply to your claim for lost income due to COVID-19.

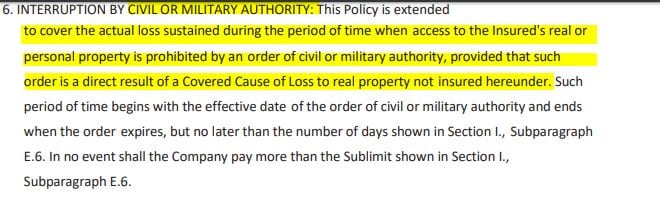

Below is an example of language that extends the policy for interruptions by civil or military authority.

You can see that, like any insurance policy, the insurance company has put in all sorts of restrictions to minimize their exposure.

Therefore, to maximize the amount of money that you have available, you want to bring both claims if they are available under your policy.

Now It’s Time For The Insurance Company To (Probably) Deny Your Claim And Tell You Why

We anticipate the insurance companies are going to initially deny your claim.

The insurance company will take the position that your loss is an uncovered loss or that there is an exclusion in the policy.

We anticipate one or more of the following three defenses:

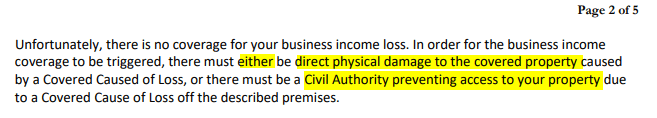

See below for sample language from an insurance denial letter from two weeks ago for a small business in the Florida Keys:

The big gun argument will be that there must be a physical loss to the property. The insurance company will keep it simple: A fire would be a physical loss. A plane crashing into your property would be a physical loss.

Your property looks the same; it’s just not open. So, no physical loss here. (We are going to go into how we address that argument a little later.)

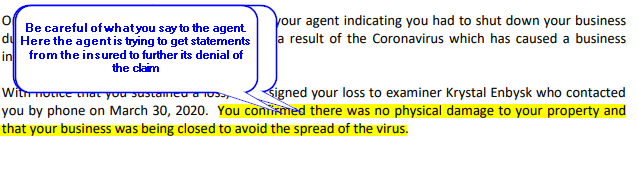

For now, just realize you should be careful with the insurance adjusters if you file a notice of a claim on your own behalf. They will try to get you to admit that there is no physical damage over the phone. See this letter of denial from an insurance adjuster:

Another anticipated argument is that civil authority is not preventing you from accessing your property due to a covered loss.

For the restaurant, they will argue that the restaurant is still “open” even if it is not open in the “normal manner.” I can foresee them arguing that essential businesses should have stayed open because they are “essential,” even if the owner has determined that the correct maneuver is to close down.

Next, we expect many policies to have virus or pandemic exclusions. These became common clauses stuffed into insurance contracts after the SARS pandemic.

Finally, anticipate some insurance companies will accept that there is a business loss, but that the business cannot prove the loss is caused by COVID-19. This argument will center on whether the business affected can prove that COVID-19 was actually present at the property or at nearby businesses to cause a civil mandate.

Then The Burden Goes Back To You To Prove There Is An Exception To The Exclusion Or The Exclusion Does Not Apply

Now, the burden is going to shift back to the business owner to prove there is an exception to the exclusion or the exclusion does not apply.

Or simply, that the insurance company is wrong.

How do lawyers do that?

The arguments have been shaping up into the following:

- There is a wide body of case law in various states that suggest that a virus can indeed be a physical loss or damage.

Physical Loss Or Damage

So, how do you prove physical loss? By showing that the coronavirus causes a non-structural physical loss to the property. Let’s start by looking at what physical loss or damage means in the context of insurance claims.

Many courts have found that physical loss or damage applies when a property owner’s ability to use the property is diminished or removed because of physical reality.

For example:

Learn How To Calculate The Value of Your Business Interruption Insurance here

Ambiguity In Contracts

Just as important, there is a contract principle that says when an insurance company writes a contract and there is ambiguity in the contract, then ambiguity should be resolved in favor of the business owner who signed the contract.

In other words, if we have different terms in the contract that are conflicting, a court can conclude that the contract itself is conflicting and read the contract in a way that’s in the best interests of the insured.

That’s because the insurance company is the one who wrote the contract! These contracts are confusing. When that confusion has been caused by the insurance company that drafted the contract, then we resolve the confusion in favor of the insured.

This is especially important in contracts with pandemic or virus exclusions. We know that these virus exclusions were added pretty recently in the mid-2000’s after the SARS issues. But in many cases, these virus exclusions are in conflict with other clauses in the contract, which is confusing. This is the most promising way for us to get around the virus exclusions when there is a contract.

Gathering Evidence

What evidence can we gather to help prove our claim?

- COVID-19 Modelling: You can’t see COVID-19. It’s a virus. But to strengthen our case, we want to show to a reasonable degree of certainty that the virus was either in the business or nearby the business — and that contributed to the loss of income. One solution is to commission experts to create COVID-19 modeling in the geographic location/area of the business.

- Antibody Testing: We anticipate that antibody testing will be available to the general population soon. If a business owner can show positive results, this could be evidence from which to infer that he was infected and therefore the virus was at the business location.

- Positive COVID-19 Tests: Likewise, positive COVID-19 tests can show that the virus was indeed present in the physical building of the business that is claiming the loss.

- $$ Damages: This is pretty straightforward. We hire a forensic accountant or other financial professionals to put this together for the court.

Pending Legislation And Political Actions

It’s important to keep an eye on the pending legislation out there. At the time of the writing of this article, there were seven states considering passing laws that will force insurance companies to pay claims. New York, New Jersey, and Louisiana are just a few.

Now, it would be surprising if these lawmakers go forward and actually pass these laws. In fact, what they would be doing is overwriting a contract between the insured and the insurance company for public policy reasons. This would probably result in a bunch of constitutional challenges to these laws.

At the same time, states have an interest in making sure that these businesses have their claims resolved. Lawmakers are not too happy when gigantic business insurance companies shirk responsibility in times of crisis.

We do know that insurance companies have gone to the federal government to request a reservoir of money to help pay COVID-19 insurance claims. This is the more likely scenario: these claims do ultimately get paid by the insurance companies to some extent, and the federal government pitches in with a reservoir of money to make sure funds are available for insurance companies to pay claims.

Also of note: President Trump himself has pressured insurance companies to pay certain business interruption claims.

Getting Started: What to Do To Bring Your Business Insurance Claim

First, Call Your Broker to Determine If You Have Business Interruption Insurance

The first step is to make sure you have business interruption insurance. Simply call your broker! Your broker should be able to tell you pretty quickly whether any of your policies have business interruption or loss of income insurance.

Second, Ignore Your Broker If He Says You Have The Insurance But It Doesn’t Apply To COVID-19.

With that said, don’t listen to your broker if he tells you that your insurance policy doesn’t apply to COVID-19. Of course he is going to say that. He sells insurance. He’s already heard from his bosses that they’re going to be denying these claims. But your broker is not in the position to know how a court of law is going to interpret these claims. Your broker is not trained in analyzing and reading these insurance policies. Your broker doesn’t know what the case law is in his jurisdiction and how it will apply to your particular document.

Therefore, find out from your broker if you have the insurance coverage — but that’s all.

Third, Have Your Broker Send You The Declarations Page And A Copy Of Your Entire Policy.

Have your broker send all of the insurance policy documents. You’re going to have this reviewed to determine if it makes sense to have a claim brought on your behalf, and what particular claims are going to be brought.

Fourth, Have Your Policy Reviewed To Determine If It’s Worth Having.

Look, I’m a lawyer putting this article together. And I hate creating an article that says, “Call a lawyer to see if you have a case!”

But the thing with these claims is that each claim can be brought on its own case by case, policy by policy, fact by fact basis.

All of these policies are written differently. They have different words that create different meanings. They have different limits and supplements. They have different coverages under the umbrella of business interruption insurance.

If a Walmart driver is texting and runs over you, it’s a no-brainer that there’s a claim. He drove for a big company and acted negligently toward another individual. We just know it.

But with insurance contract claims, we don’t know the value of the claim until we get into the actual nitty-gritty of the language. Contract claims by their very nature are about what is in the four corners of the contract.

Not to mention, each business is going to have different losses that range in severity. Different businesses are going to have done different things to try to mitigate their losses. For example, some businesses will have remained open for drive-thru traffic and making deliveries. Other businesses will have just flat out closed. Some businesses will have retained their employees.

Different states have different laws and case law as to how they interpret the different provisions in the different languages in these contracts.

Most importantly, this is all brand new. COVID-19 wasn’t even on your radar just a couple of months ago. And now, it’s potentially devastating your business.

There is no case law yet that applies specifically to COVID-19. It’s just too new.

So all of that said, hopefully, this article helped you understand these concepts and will allow you to get your contract and take a look for yourself. Do, however, have an attorney who primarily deals with insurance policy disputes in court review your claim for you.

Our Expertise

We have your back. Whatever you might be suffering from, accidents, injuries or medical malpractice, we have you covered throughout Florida

Let’s get in touch!

The initial consultation is absolutely FREE

Denmon Pearlman

Law

Tampa Office

2504 W Crest Ave

Tampa, FL 33614

(813) 554-3232

Denmon Pearlman

Law

St. Petersburg Office

520 2nd Ave South

St. Petersburg, FL 33701

(727) 493-5610

Denmon Pearlman

Law

New Port Richey Office

5703 Main Street

New Port Richey, FL 34652

(727) 753-0049

Denmon Pearlman

Law

Brooksville Office

1790 E Jefferson St.

Brooksville, FL 34601

(352) 309-7354

Denmon Pearlman

Law

Seminole Office

5290 Seminole Blvd. Suite D

St. Petersburg, FL 33708